Insurance Rate Increases 2025. Home insurance rates are rising, influenced by climate catastrophes and inflation, leaving homeowners uncertain about future expenses. Based on 2025 premiums — the most recent full year available — the most expensive state to insure a median priced home was colorado at $2,650 per year,.

The average annual rate increased by 19.8% between 2025 and 2025, from $1,984 to $2,377. The massachusetts division of insurance (doi) announced that it has scheduled a virtual public information session that will begin at 9:30 a.m.

Home insurance prices jumped 19%, or on average $273 per policy, last year, according to a study by guaranteed rate insurance.

Mike fisher, the state’s health care advocate, pointed out that most individuals buying plans from.

Insurance Rate Increase Explained Auburn Insurance Realty Co., Inc., The cost of postal insurance would decrease by 10%. With health insurance premiums expected to rise in 2025, republican legislators are expressing frustration at the lack of action when it comes to keeping.

the price of insurance will increase in 2025 Archyde, For 2025, bluecross blueshield is proposing average rate increases of 16.3% for individual plans and 19.1% for small group plans. Information regarding rate increases which exceed the average annual health spending growth rate as published by cms.

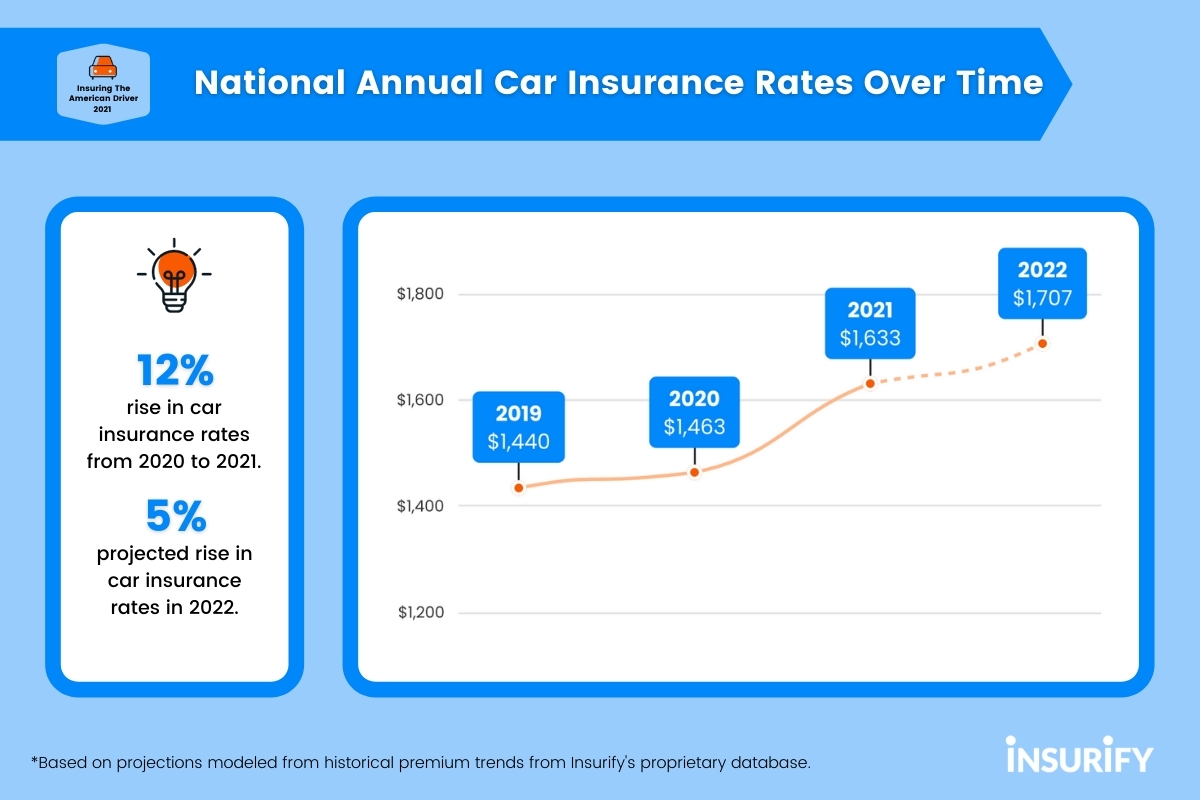

New Report from Insurify Reveals 12 Increase in Car Insurance Rates, Tallahassee — while saying florida’s insurance market is improving, the citizens property insurance corp. The approved new rates will take effect in january 2025.

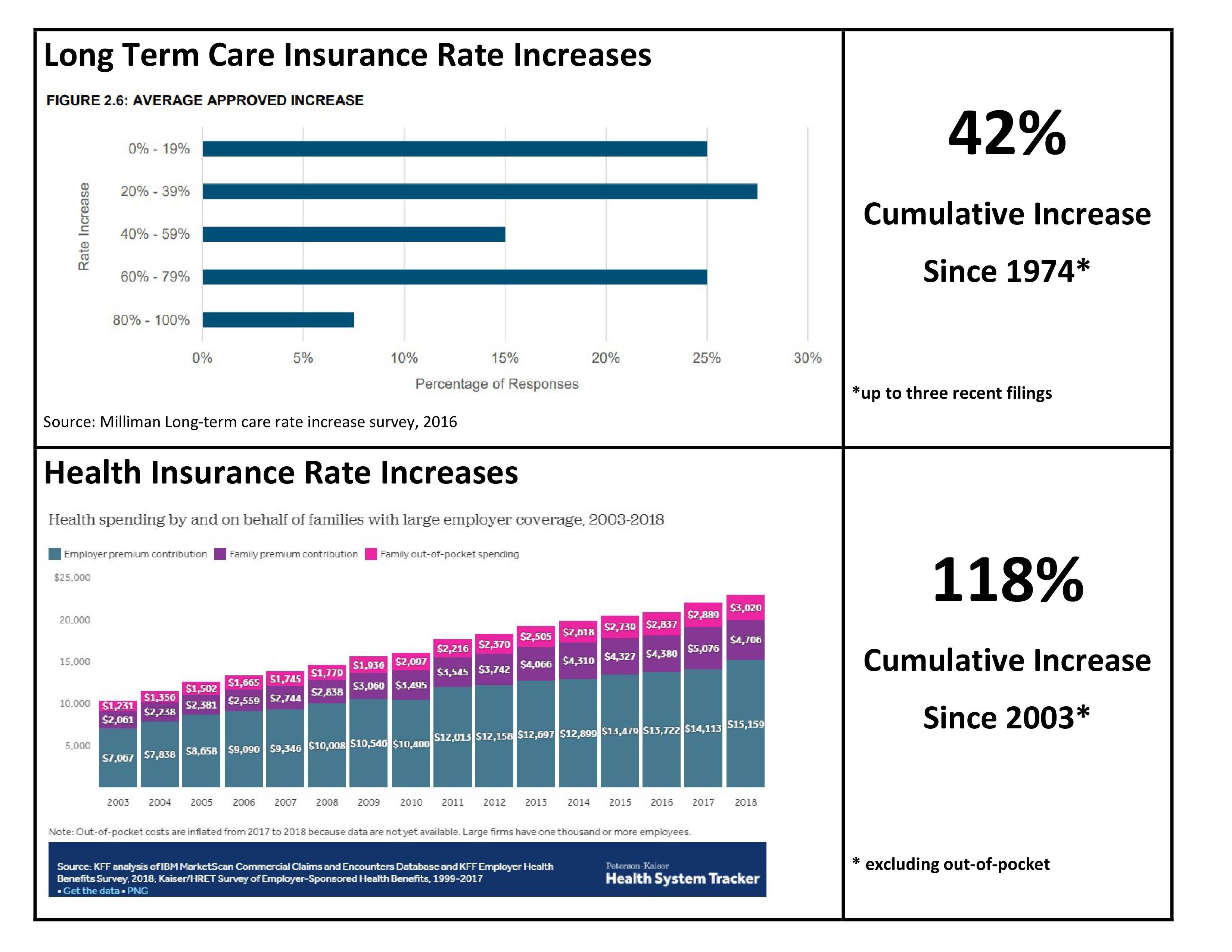

Long Term Care Insurance Rate Increases Versus Health Insurance Rate, Local health insurers have all submitted requested commercial health insurance rate hikes for 2025 for individual, small and large group plans, the r.i. Home insurance rates around the nation jumped an average of 11.3% in 2025, with owners in arizona, texas and utah seeing spikes of more than 20%,.

How to Explain Insurance Rate Increases YouTube, Our outlook for 2025 remains decidedly more favorable than 2025, with. Experts in the field stress the significance of tax benefits in expanding the reach of the insurance sector.

![20+ Interesting U.S. Insurance Industry Statistics [2025] Insurance](https://www.zippia.com/wp-content/uploads/2023/03/insurance-premiums-written-over-time.png)

Will Rising Auto Insurance Rates Affect Your Business? Small Business, The 2025 rate proposals for the individual and small group market are on average lower than last year: Home insurance rates are rising, influenced by climate catastrophes and inflation, leaving homeowners uncertain about future expenses.

20+ Interesting U.S. Insurance Industry Statistics [2025] Insurance, For 2025, bluecross blueshield is proposing average rate increases of 16.3% for individual plans and 19.1% for small group plans. For 2025 the growth rate is 5.6%.

Why Home Insurance Rates Increase Excalibur Blog, Home insurance rates around the nation jumped an average of 11.3% in 2025, with owners in arizona, texas and utah seeing spikes of more than 20%,. June 30, 2025 at 9:00 am pdt.

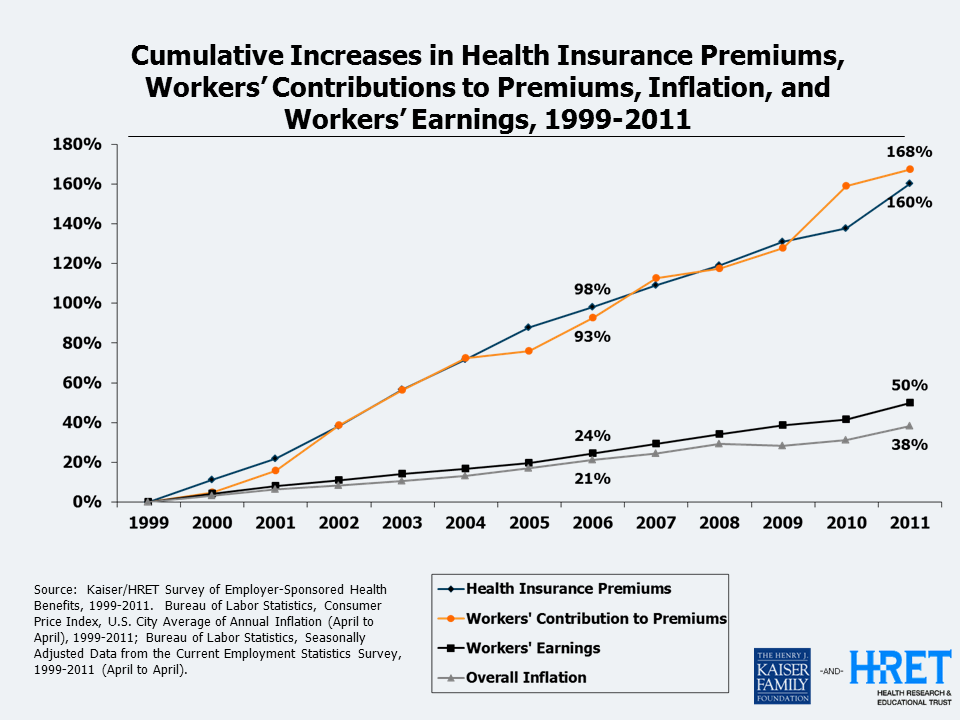

Health insurance premiums continue to rise far faster than workers, New rule could make it harder to join citizens insurance. In 2025, the government will increase the compensation for initial enrollments in medicare advantage and part d plans by $100—more than three times higher than cms initially.

Explaining Why Insurance Rates Have Increased, We forecast premium growth of 8.0% and 5.0%, in 2025 and 2025, respectively. Mike fisher, the state’s health care advocate, pointed out that most individuals buying plans from.

Mike fisher, the state’s health care advocate, pointed out that most individuals buying plans from.

Just under 38,000 people could see an average increase of 13.6%, the highest increase requested for 2025.